With respect to financial, Gesa Borrowing from the bank Relationship is like a friendly neighbors who may have usually indeed there to you personally. Rather than huge finance companies, Gesa is approximately area, getting players earliest and you will targeting exactly what very issuesfinancial better-getting.

If you reside in the Pacific Northwest, capable to offer team credit choice designed with the demands, whether it is credit cards, mortgage, otherwise savings account.

Therefore, within feedback, we are diving toward Gesa’s lineup from company-amicable choices, of perks towards handmade cards so you can versatile financing and you will coupons options. Let us see if Gesa is a good matches to suit your business financial need.

What’s Gesa Credit Relationship?

Gesa Credit Connection was an associate-had financial institution. It serves new monetary means men and women and you can businesses, especially small businesses.

It credit partnership is founded in the 1953 of the a team of General Electric supervisors. Ever since then, it’s grown into one of the greatest borrowing from the bank unions in Washington county. Gesa’s purpose should be to serve their users and you will organizations by giving reasonable borrowing products and properties. This can include a powerful commitment to supporting local enterprises and you will community development.

Gesa Credit Relationship try intent on providing small businesses prosper. They are aware one to small enterprises are vital with the regional savings and you may area.

- They give different team examining and savings levels to see different means.

- Gesa participates for the Home business Administration (SBA) loan applications, delivering usage of investment which have good bad credit installment loans New Hampshire terms.

- Its treasury administration services let businesses carry out their cash disperse efficiently.

- Gesa now offers title loans and personal lines of credit to assist organizations funds surgery and you can gains.

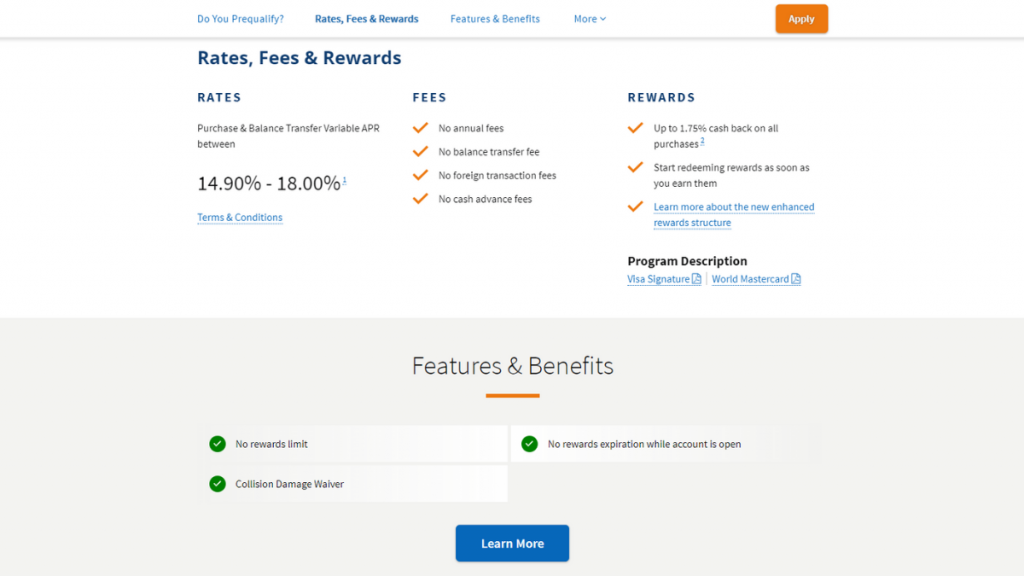

- They give you team Visa cards having competitive pricing and you can rewards.

Gesa Credit Relationship targets keeping money into the neighborhood, supporting local universities, teams, and you may businesses. When you lender with Gesa, your assist help such local attempts and you can subscribe to the entire well-being of one’s society.

Towns Supported

Gesa Borrowing from the bank Commitment suits businesses primarily during the Arizona state, which have branches in Richland, Pasco, Kennewick, Walla Walla, Moses River, Yakima, Wenatchee, Pullman, Spokane, Puyallup, Seattle, Tacoma, Kirkland, Lynnwood, and Bremerton. In addition, they have a branch when you look at the Blog post Falls, Idaho.

To enhance accessibility, Gesa also offers detailed online attributes, as well as on the internet and mobile banking owing to their Gesa commit application. Users is also manage accounts, transfer fund, make ends meet, and put checks from another location.

In addition to, Gesa Borrowing from the bank Union falls under the fresh new CO-OP Financial Functions System, the following prominent branch community regarding U.S. This enables Gesa people to get into almost 200 towns and cities for the Arizona Condition and perform banking on borrowing from the bank unions all over the country. In addition, members have access to more 77,000 surcharge-100 % free ATMs all over the country, and therefore ensures simpler financial wherever youre.

Registration and you may Qualifications

In order to become a corporate member of Gesa Borrowing from the bank Partnership, the firm must meet specific eligibility conditions. Organizations qualify when they located in Washington state, or get a hold of areas into the Idaho and Oregon.

Especially, these types of areas into the Idaho are Benewah, Bonner, Edge, Clearwater, Idaho, Kootenai, Latah, Lewis, Nez Perce, and Shoshone. Within the Oregon, qualified areas is actually Clackamas, Clatsop, Columbia, Gilliam, Hood River, Morrow, Multnomah, Sherman, Umatilla, Commitment, Wasco, and you can Washington.

In addition, people owned by individuals who real time, performs, praise, or attend college or university on these section, or whoever has a relative exactly who qualifies, can also signup.

- Make sure your business is located in the qualified aspects of Washington, Idaho, or Oregon.

- Unlock your own checking or checking account with Gesa.

- Get ready key company facts, for instance the team name, address, and you can income tax identification number.

- Owners or authorized signers is prepared to offer personal personality (e.g., license) and you may confirmation guidance depending on Government conditions to combat terrorism and you may money laundering.